south carolina estate tax 2020

Income tax refund checks of up to 800 will be sent out to South Carolina taxpayers starting in late November or December 2022. Title 12 - Taxation.

The Ultimate Guide To South Carolina Real Estate Taxes

South Carolinas median income is 52001.

. Every employerwithholding agent that has an employee earning wages in South Carolina and who is required to file a return or deposit with the IRS must make a return or deposit to the SCDOR for any taxes that have been withheld for state purposes. 65 on taxable income over 16039 Beginning with the 2023 tax year and each year thereafter until it. Municipalities levy a tax on property situated within the limits of the municipality for services.

Instructions - 2020 SC1040 - South Carolina Individual Income Tax Return Worksheet for state tax addback 1. CHAPTER 54 - UNIFORM METHOD OF. The SC Department of Revenue publishes online tutorials and sponsors tax seminars and workshops throughout the.

Manage Your South Carolina Tax Accounts Online. A The property of an authority is declared to be public property used for essential public and governmental purposes and such property of an authority shall be exempt from all taxes and special assessments of the city the county the State or any political. South Carolina has no estate tax for decedents dying on or after January 1 2005.

Real and personal property are subject to the tax. Get Access to the Largest Online Library of Legal Forms for Any State. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

South Carolina has a 037 combined state and county transfer tax. Certain taxable income such as real estate gains and rentals from property located in South Carolina and income flowing through from a business located in South Carolina and distributable to nonresident. South Carolina does not levy an inheritance or estate tax but like all states it has its own unique set of laws regarding inheritance of estates.

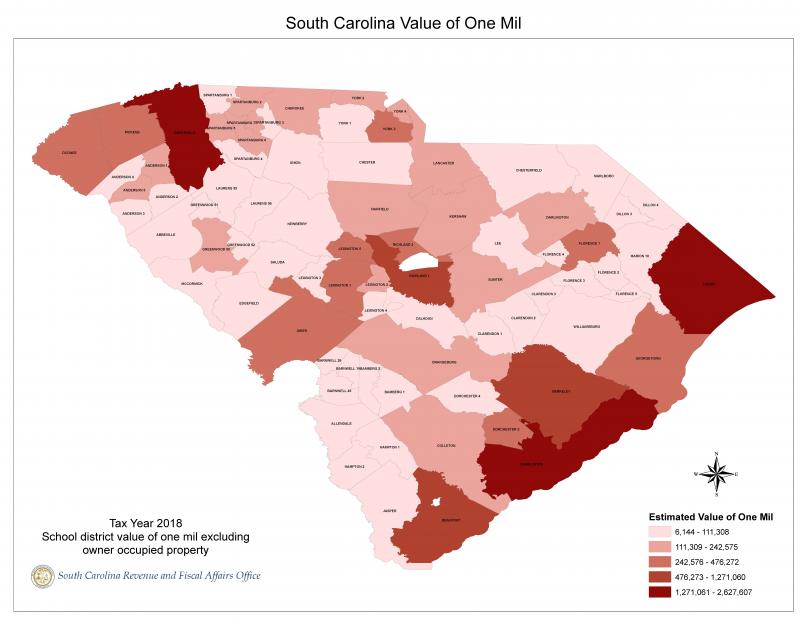

South Carolina Code of Laws. The SC Department of Revenue publishes online tutorials and sponsors tax seminars and workshops throughout the. Approximately two-thirds of county-levied property taxes are used to support public education.

Real or tangible personal property located within South Carolina. South Carolina Income Tax Range. Property Tax Rates by County 2019 - Dec 19 2019.

It is one of the 38 states that does not have either inheritance or estate tax. South Carolina has one of the lowest median property tax rates in the United States with only five states collecting a lower median property tax than South Carolina. South Carolina taxable income of estates and trusts is taxed either to the fiduciary or to the beneficiaries in the same manner as federal Income Tax purposes.

However the Palmetto States income tax is between 0. CHAPTER 35 - THE SIMPLIFIED SALES AND USE TAX ADMINISTRATION ACT. Ad Real Estate Family Law Estate Planning Business Forms and Power of Attrorney Forms.

CHAPTER 14 - ECONOMIC IMPACT ZONE COMMUNITY DEVELOPMENT ACT OF 1995. Not all estates must file a federal estate tax return Form 706. Subtract real estate taxes and personal property taxes reported on federal Schedule A from the federal limit of 10000 5000 if MFS.

See what makes us different. In this detailed guide of South Carolina inheritance laws we break down intestate succession probate taxes what makes a will valid and more. The median property tax in South Carolina is 68900 per year05 of a propertys assesed fair market value as property tax per year.

If they are married the spouse may be able to leave everything to each other without paying any estate tax. Section 31-3-570 of the 1976 Code is amended to read. Tax amount varies by county.

Income from South Carolina sources includes income or gain from. CHAPTER 51 - ALTERNATE PROCEDURE FOR COLLECTION OF PROPERTY TAXES. The website is a dynamic tool that provides access to information about our services conferences.

3 on taxable income from 3200 to 16039 High. Itemized deductions from 2020 federal 1040 Schedule A line 17. Any resident who paid taxes will receive a rebate.

There are no inheritance or estate taxes in South Carolina. Securely file pay and register most South Carolina taxes using the SCDORs free online tax portal MyDORWAY. For a median South Carolina home of 165800 the transfer tax would be 613.

Withholding Tax is taken out of taxpayer wages to go towards the taxpayers total yearly income tax liability. In addition gifts to spouses who are not US. To amend the code of laws of south carolina 1976 by adding chapter 5 to title 12 so as to enact the south carolina income tax act for individuals trusts and estates to provide beginning with taxable year 2021 a single or flat rate income tax rate of 485 percent phasing down over five years to a rate of 45 percent to change the states individual income tax base from federal.

Enter the difference but not less. Check the status of your South Carolina tax refund. If youre planning an estate or just inherited money it can be a good idea.

The fiduciary of a nonresident estate or trust must file a South Carolina Fiduciary Income Tax return if the estate or trust had income or gain that came from South Carolina sources. Property Tax Rates by County 2020 - Jan 5 2021. Most of the time in South Carolina the seller pays the transfer tax.

However occasionally transfer tax is part of the negotiation between the buyer and seller. A married couple is exempt from paying estate taxes if they do not have children. Check the status of your South Carolina tax refund.

Property tax is administered and collected by local governments with assistance from the SCDOR. We dont make judgments or prescribe specific policies. Securely file pay and register most South Carolina taxes using the SCDORs free online tax portal MyDORWAY.

However for decedents dying in 2014 a Form 706 must be filed if the total estate value for federal tax purposes called the gross estate which is the total value of the decedents assets located in South Carolina and elsewhere exceeds 5340000. Manage Your South Carolina Tax Accounts Online.

South Carolina Estate Tax Everything You Need To Know Smartasset

Moving To South Carolina 12 Reasons You Ll Love Living In Sc

Real Estate Property Tax Data Charleston County Economic Development

South Carolina Property Tax Rate Guide Easyknock

A Guide To South Carolina Inheritance Laws

South Carolina Vs North Carolina Which Is The Better State Of The Carolinas

South Carolina Retirement Tax Friendliness Smartasset

South Carolina Tax Rates Rankings Sc State Taxes Tax Foundation

South Carolina Lawmakers Reach Deal To Cut Income Tax

Complete E File Your 2021 2022 South Carolina State Return

Ultimate Guide To Understanding South Carolina Property Taxes

South Carolina Estate Tax Everything You Need To Know Smartasset

South Carolina Estate Tax Everything You Need To Know Smartasset

South Carolina Tax Rates Rankings Sc State Taxes Tax Foundation

A Guide To South Carolina Inheritance Laws

South Carolina Property Tax Calculator Smartasset

South Carolina Sales Tax Small Business Guide Truic

Property Tax Reports South Carolina Revenue And Fiscal Affairs Office